Self Directed IRA

Discover the power and flexibility of Self-Directed IRAs! Unleash your retirement portfolio’s potential with alternative investments like real estate, cryptocurrencies, private companies, and precious metals. Learn how to set up and manage your self-directed IRA while navigating rules and regulations, as well as the key benefits and risks involved. Plus, explore how this unique investment vehicle can play a crucial role in your estate planning. Dive into the world of self-directed IRAs and unlock the door to a more rewarding and personalized retirement strategy!

Simplified Employee Pension (SEP) IRAs

Updated: July 2025 Building a nest egg for retirement is critical to your financial security, but where do you start? As a small business owner or self-employed individual, a Simplified Employee Pension (SEP) IRA allows you to maximize tax-advantaged retirement contributions far beyond a traditional IRA. You owe it to yourself and your employees to […]

403b and 457 Plans

Updated: July 2025 Are you a public sector employee looking to ramp up your retirement savings? 403(b) and 457 plans offer substantial tax benefits and contribution limits to help you generate retirement wealth. These plans, available through non-profits, schools, churches, and government agencies, let you sock away tens of thousands of dollars each year for […]

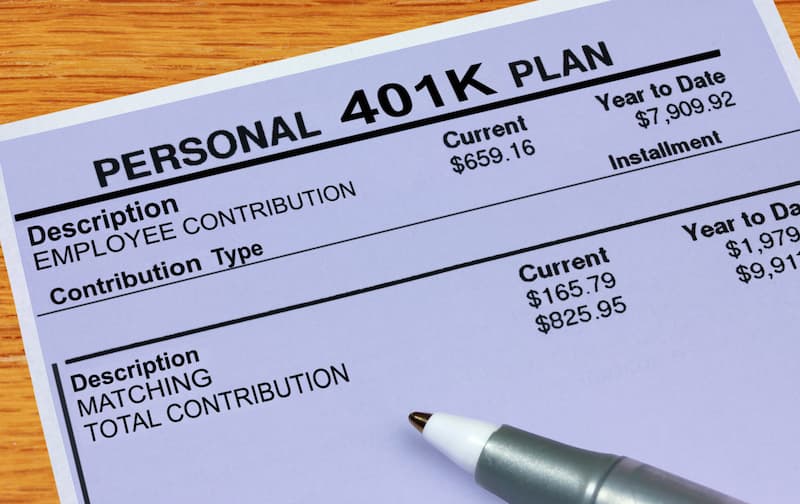

401k Plans

Updated: July 2025 Saving enough for retirement is critical to your financial security, and your 401(k) plan is likely your best tool to build wealth for the future. With a 401(k), you can contribute automatically from each paycheck, lower your taxes now, and take advantage of free money from your employer’s matching contributions. The power […]

Roth Individual Retirement Accounts (Roth IRAs)

Updated: July 2025 What if you could enjoy your retirement years with a sizable nest egg that provides tax-free income? No paying the taxman. No worries about minimum distributions. The freedom to use your money as you please. With a Roth IRA, this tax-free retirement dream can be your reality. You have the power to […]

Traditional Individual Retirement Accounts (IRAs)

Updated: July 2025 Are you looking to save money on your taxes and invest in your future? If so, a Traditional IRA is a smart option you should consider. Traditional IRAs allow you to contribute money for retirement that is tax-deductible now, meaning you can lower your tax bill each year. Your contributions also provide […]