Updated: July 2025

Saving enough for retirement is critical to your financial security, and your 401(k) plan is likely your best tool to build wealth for the future.

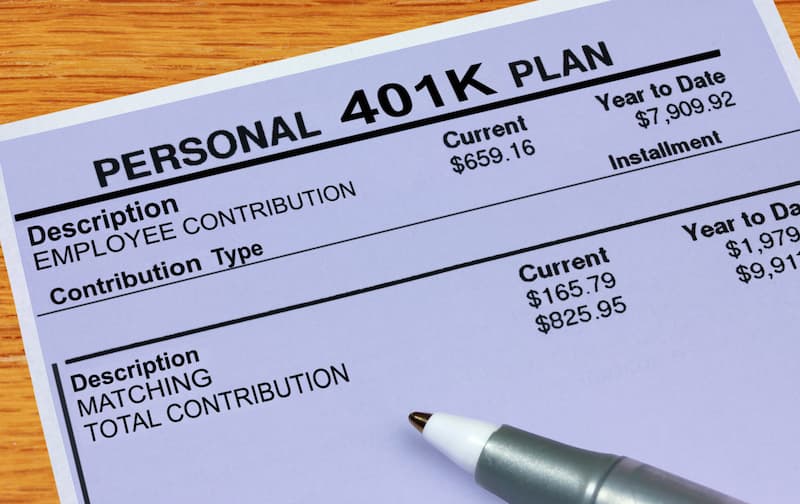

With a 401(k), you can contribute automatically from each paycheck, lower your taxes now, and take advantage of free money from your employer’s matching contributions.

The power of tax-advantaged, compounded growth over time means your 401(k) balance can accumulate into hundreds of thousands of dollars—or more—to fund your retirement dreams.

But you must take action today to reap the benefits. Contribute at least enough to get any matching offered, then increase your rate by at least 1-2% each year until you reach 10-15% of your salary. Stay invested for the long run. And meet with a financial advisor to ensure you make the most of this valuable benefit.

Your retired self will thank you.

How 401(k) Plans Work

For retirement saving at work, a 401(k) plan may be your best option. These employer-sponsored accounts allow you to contribute pre-tax dollars from your paycheck to save for retirement. Many employers provide matching contributions to help boost your savings.

With a 401(k) plan, you specify a percentage of your salary to contribute from each paycheck. This lowers your taxable income for the year while allowing your money to grow tax-deferred until withdrawal. At retirement, withdrawals are taxed as ordinary income.

The Benefits of 401(k) Plans

Two key benefits of 401(k) plans are employer matches and tax advantages. If your employer provides matching contributions, take full advantage of them. It’s free money that can significantly enhance your retirement savings. And contributing pre-tax lowers your taxable income now for tax savings, while your money grows tax-free for the future.

401(k) plans offer several benefits for retirement saving:

- Tax advantages: Contributions lower your taxable income now. Money grows tax deferred for potentially decades.

- Employer matching: Plans frequently match 50 to 100% of your contributions up to a cap like 3 to 6% of your salary. This is free money that can significantly boost your retirement savings over time through the power of compounding.

- Higher contribution limits: For 2025, you can contribute up to $23,500 per year to a 401(k) plan ($31,000 if over 50, or $34,750 if between ages 60-63). This is more than allowed for IRAs.

- Enhanced catch-up contributions: Employees aged 60-63 can now make “super catch-up” contributions of $11,250 (in addition to the regular $7,500 catch-up), allowing total contributions of up to $34,750.

- Automatic enrollment: Many plans now automatically enroll you so you have to opt out of contributing. Starting in 2025, most new plans must include automatic enrollment with annual increases. This feature has greatly increased employee participation and long term saving.

- Emergency withdrawals: Starting in 2024, you can withdraw up to $1,000 annually for emergency expenses without the 10% early withdrawal penalty, with repayment options available.

- Student loan matching: Some employers now provide matching contributions based on your student loan payments, helping you build retirement savings while paying down debt.

- Loans permitted: You may be able to borrow a portion of your vested balance, paying it back with interest. Taxes and penalties apply if you default on the loan.

- Hardship withdrawals: Some plans allow you to withdraw money in case of financial hardship. Taxes and penalties usually apply.

New Emergency Withdrawal Provisions

One of the most significant recent changes allows penalty-free emergency withdrawals starting in 2024:

- Annual limit: Up to $1,000 per year for emergency expenses

- No penalty: The usual 10% early withdrawal penalty is waived

- Broad definition: You define what constitutes an emergency relating to necessary personal or family expenses

- Account protection: Withdrawals cannot reduce your account balance below $1,000

- Repayment benefits: If you repay within three years, you avoid income tax and become eligible for another emergency withdrawal

- Cooling-off period: If not repaid within three years, you must wait three years before taking another emergency withdrawal

Traditional 401(k) vs. Roth 401(k)

Traditional 401(k)s provide pre-tax contributions and tax-deferred growth, with taxes due on withdrawals in retirement. Roth 401(k)s use after-tax dollars, so qualified withdrawals are tax-free. Starting in 2024, Roth 401(k) accounts are no longer subject to required minimum distributions during your lifetime, providing even greater flexibility. The choice depends on your tax bracket now and expected in retirement. Often, a blend of both is optimal.

Contribution Limits and Enhanced Options

For 2025, contribution limits have increased and new options are available:

- Standard limit: $23,500 for employees under 50

- Ages 50+: Additional $7,500 catch-up contribution (total $31,000)

- Ages 60-63: Enhanced “super catch-up” of $11,250 (total $34,750)

- No income limits: Unlike IRAs, there are no income restrictions for 401(k) contributions

- Future requirement: Starting in 2026, employees earning over $145,000 must make catch-up contributions on a Roth (after-tax) basis

Mandatory Automatic Enrollment

Beginning in 2025, most new 401(k) plans must include automatic enrollment features:

- Initial rate: 3-10% of compensation automatically deducted

- Annual increases: At least 1% per year until reaching 10-15%

- Opt-out option: Employees can still choose not to participate or adjust their rate

- Exemptions: Small businesses (10 or fewer employees), new businesses (less than 3 years), and certain government/church plans are exempt

Expanded Eligibility and Portability

Recent changes have made 401(k) plans more accessible:

- Part-time workers: Eligibility period reduced from three years to two years for employees working at least 500 hours annually

- Automatic portability: Small account balances (up to $7,000) can automatically follow you when changing jobs, preventing lost retirement savings

- Student loan matching: Employers can now provide matching contributions based on student loan payments, helping younger workers build retirement savings while managing debt

Handling Your 401(k) When Changing Jobs

When leaving an employer, you have options for your 401(k) funds. Withdraw the money and face taxes and potential penalties. Leave it in the old plan. Roll it into your new employer’s plan if allowed. Or roll it into an IRA, allowing more investment freedom and possibly lower fees. With new automatic portability rules, small balances may automatically transfer to your new plan. Consult a financial professional to determine the best choice based on your unique situation.

Traditional vs. Roth 401(k)

A 401(k) plan allows you to save for retirement directly from your paycheck with tax advantages. You must choose between a traditional 401(k) and a Roth 401(k). With a traditional 401(k), you contribute pre-tax dollars, reducing your taxable income for the year. Money grows tax-deferred and withdraws in retirement taxed as income. A Roth 401(k) uses after-tax dollars, so qualified withdrawals are tax-free.

Deciding between traditional and Roth depends on your tax situation now versus in retirement. If you expect higher taxes in retirement or want to leave an inheritance, a Roth 401(k) may be better. Your money can potentially grow tax-free for life and be withdrawn tax-free. However, if your income is higher now than anticipated in retirement, a traditional 401(k) provides an immediate tax benefit. You get a tax deduction on contributions, allowing more money to remain invested compared to a taxable account.

Both 401(k) options allow matching contributions from employers and the same high contribution limits. For 2025, you can contribute $23,500 or $31,000 if age 50 or older, or $34,750 if between ages 60-63. There are no income limits to consider. However, employer matches are taxable for Roth accounts. With traditional, matching contributions and earnings remain tax-deferred until withdrawal.

Required minimum distributions begin at age 73 for traditional 401(k)s to avoid penalties, but starting in 2024, RMDs are no longer required for Roth 401(k) accounts during your lifetime. This provides significantly more flexibility if you don’t need distributions and want to leave tax-free assets to heirs.

For the most tax benefits, contribute at least enough to get your full employer match, then fund a Roth IRA before contributing more to your 401(k). A mix of traditional and Roth also provides tax diversification since future tax rates are uncertain. But choose primarily either traditional or Roth based on your needs and goals. Take advantage of enhanced catch-up contributions at ages 60-63 and plans allowing after-tax contributions beyond limits for greater tax-free saving potential.

Investment Options

401(k) plans provide a wide range of investment options to choose from based on your goals and risk tolerance:

- Target date funds: Select a fund matching your projected retirement year. It invests aggressively early on, becoming more conservative over time. Simple but fees can be high.

- Index funds: Track the stock market, generating returns at low cost. Provide broad market exposure, good for those with a long time to invest.

- Stock funds: Focus on equity investments, aiming for higher returns. More volatility but potential for strong gains over time.

- Bond funds: Hold debt investments, providing income with modest and stable returns. Balance risk in a portfolio.

- Guaranteed options: Fixed and variable annuities provide principal protection or guaranteed income. Fees are typically highest of all options.

- Self-directed brokerage: For experienced investors, choose your own stocks, bonds, ETFs, and mutual funds. Offers most flexibility but requires hands-on management and incurs trading fees.

Working with Financial and Tax Professionals

Managing your 401(k) and overall retirement strategy requires understanding complex rules and options. With recent legislative changes adding new features like emergency withdrawals, enhanced catch-up contributions, and evolving Roth options, partnering with financial and tax professionals helps ensure you make the most of your 401(k), select suitable investments, and achieve your long-term goals. Let the experts guide you to a secure retirement.

Wrapping Up

You know by now how valuable your 401(k) can be for retirement. But knowledge alone doesn’t build wealth. You must take action today to maximize this financial opportunity.

Contribute at least enough to get any matching offered by your employer. Then increase your rate every year until saving 10-15% of your pay. Take advantage of new features like emergency withdrawal provisions and enhanced catch-up contributions if you’re eligible. Consider student loan matching if your employer offers it. Open a Roth IRA too and fund it fully if possible. Stay invested for the long run through all markets ups and downs. Meet with a financial advisor to craft a personalized retirement plan using tax-advantaged accounts and sound investment strategies tailored to your needs.

Recent changes have made 401(k) plans more flexible and accessible than ever before. With automatic enrollment becoming mandatory for new plans, emergency withdrawal options, and enhanced contribution limits, there are more opportunities to build retirement wealth while maintaining financial flexibility.

Your older self will look back in gratitude at the gift of financial freedom and stability you provided. But that gift requires your deliberate action and discipline today. Seize control of your financial future through your 401(k) and other retirement accounts. Let the power of tax-advantaged, compounded growth over time turn your steady contributions into a nest egg that provides income for life.

The choice is yours. Take action now or regret the opportunity lost forever. Your 401(k) holds the promise of a comfortable retirement. Make that promise a reality.